President Trump’s Next Fed Pick: What It Means for Interest Rates and Housing in 2026

As the nation looks ahead to 2026, all eyes are on President Trump’s anticipated selection of the next chairman of the Federal Reserve. This decision isn’t just about monetary policy—it’s about the everyday lives of millions of Americans, especially those dreaming of homeownership or struggling with high mortgage rates.

Rumors are swirling that President Trump is seeking a candidate who is openly supportive of lowering interest rates. Such a move could be a game-changer for the housing market, potentially making homes more affordable and accessible for first-time buyers and families alike.

Why the Fed Chair Matters for Your Wallet

The Federal Reserve wields enormous influence over borrowing costs. When the Fed lowers interest rates, it becomes cheaper to borrow money—for everything from credit cards to car loans to, most importantly, mortgages. Lower rates can mean lower monthly payments, which often opens the door for more people to buy homes or refinance existing loans.

- First-time buyers: Lower rates can make that first home a real possibility instead of a distant dream.

- Current homeowners: Refinancing at a lower rate can free up money for other important expenses.

- The broader economy: Increased homebuying activity can boost local businesses, create jobs, and spark new construction.

The Politics of Affordability

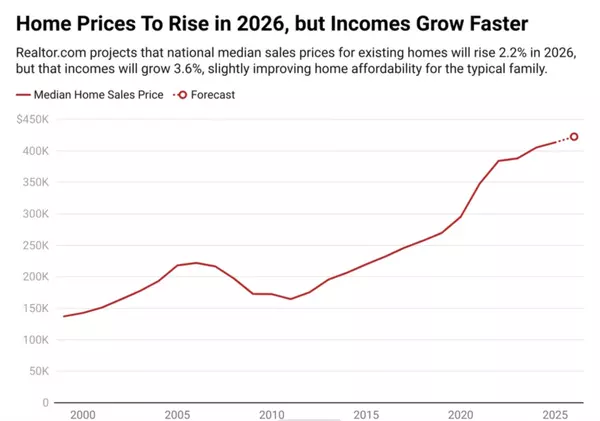

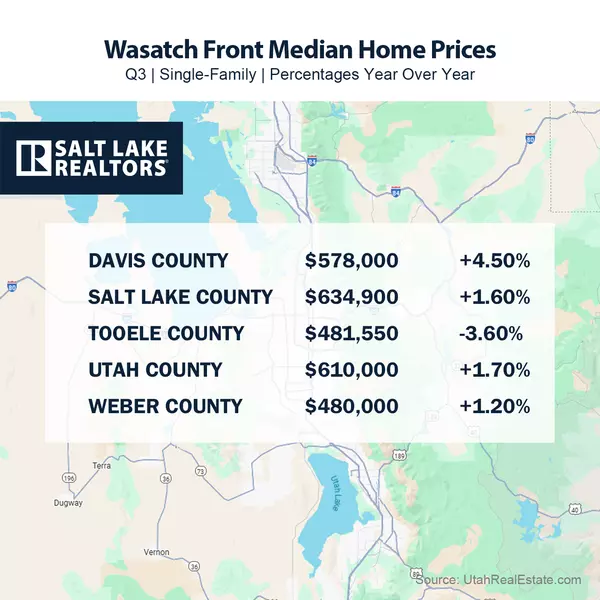

Housing affordability has become a hot-button issue across the country. Rising home prices, limited inventory, and higher mortgage rates have squeezed many would-be buyers out of the market. By selecting a Fed chair committed to keeping rates low, President Trump could be signaling a bold move to tackle these challenges head-on.

Of course, there are trade-offs. Critics warn that too-low interest rates could fuel inflation or create asset bubbles. The next Fed chair will need to balance the desire for affordable housing with the need to keep the broader economy stable.

What Should Homebuyers Watch For?

As the nomination process unfolds, keep an eye on the economic philosophy of the candidates. Are they vocal about supporting lower rates? Do they have a track record of prioritizing growth and affordability? Their answers could shape the housing market for years to come.

It’s an exciting—and uncertain—moment for anyone interested in real estate. If President Trump’s pick delivers on the promise of lower rates and greater affordability, 2026 could be the year more Americans finally get the keys to their own front door.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "